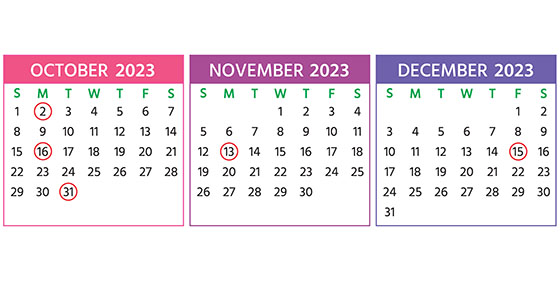

Emil @ CPA Restaurant tips: New per diem business travel rates kicked in on October 1

Are employees at your business traveling and frustrated about documenting expenses? Or perhaps you’re annoyed at the time and energy […]

Emil @ CPA Restaurant tips: New per diem business travel rates kicked in on October 1 Read More »