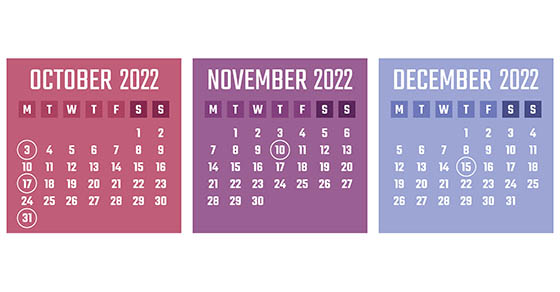

2022 Q4 tax calendar: Key deadlines for businesses and other employers

Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2022. Keep […]

2022 Q4 tax calendar: Key deadlines for businesses and other employers Read More »